Introduction

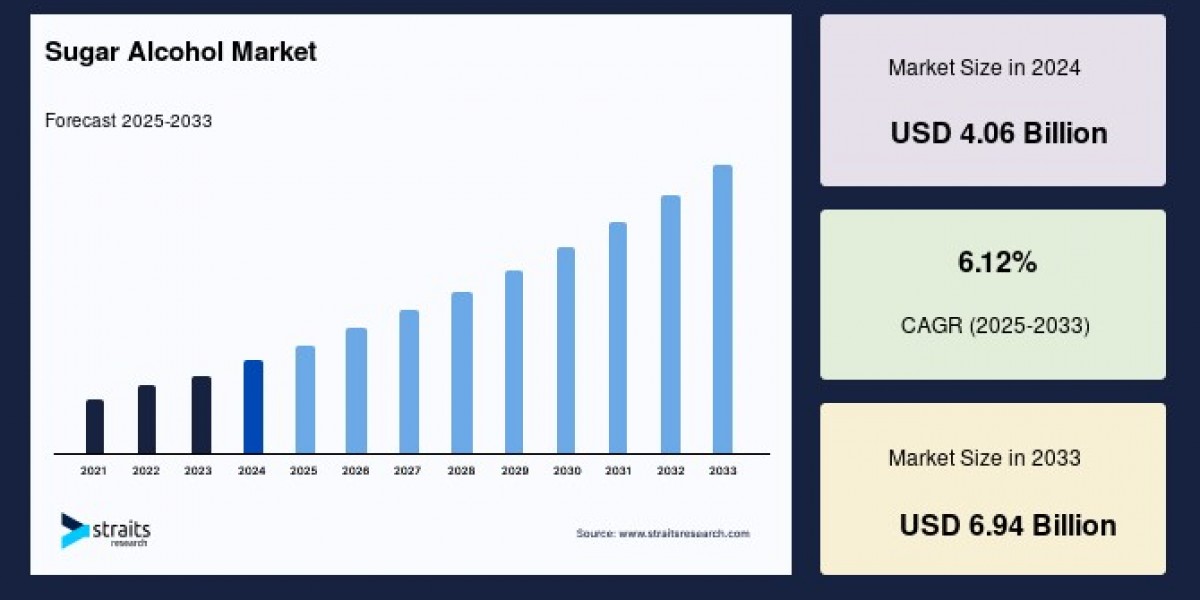

The global sugar alcohol market size was valued at USD 4.06 billion in 2024 and is projected to grow from USD 4.31 billion in 2025 to reach USD 6.94 billion by 2033,growing at a CAGR of 6.12% during the forecast period (2025-2033).

What Are Sugar Alcohols?

Sugar alcohols are a class of organic compounds derived naturally from sugars found in plants including sugarcane, sugar beet, molasses, cereals, and fruits. Chemically, they are white, water-soluble solids that offer sweetness comparable to sugar but with fewer calories and a lower glycemic impact. Common types include sorbitol, xylitol, erythritol, and maltitol. These compounds are neither typical sugars nor traditional alcohols but serve as excellent sugar substitutes in reduced-calorie and sugar-free formulations.

Market Growth Drivers

The primary factors fueling market expansion include rising consumer awareness about the health risks associated with excessive sugar intake, such as obesity and diabetes. As health-conscious consumers seek healthier diet alternatives, sugar alcohols are increasingly incorporated into products like sugar-free candies, baked goods, dairy items, and beverages.

Additionally, sugar alcohols provide beneficial functional properties like improved sweetness balance, bulking, stabilizing, and anti-crystallizing effects, which make them valuable to food manufacturers aiming to maintain taste and texture while lowering sugar content. Their safety profile, being free from harmful additives and possessing moderate glycemic indices, further drives consumer preference and acceptance.

The pharmaceutical and nutraceutical sectors also spur growth by utilizing sugar alcohols as excipients and active ingredients in formulations such as syrups, lozenges, chewable tablets, and soft gels. Their solubility and non-cariogenic properties render them ideal for various health-related applications.

Regional Market Insights

Europe commands the largest share of the sugar alcohol market due to its mature pharmaceutical industry and high demand for low-calorie and sugar-free products. European consumers’ strong preference for natural ingredients and clean-label products further supports demand.

North America, noted for widespread obesity and growing health awareness, represents a fast-growing market, with consumers increasingly favoring low-calorie yogurts, smoothies, and soft drinks enhanced with sugar alcohols.

The Asia-Pacific region is projected to witness the fastest growth during the forecast period. Rising disposable income, increased health awareness, and growing demand for sugar-free pharmaceuticals and dietary supplements stimulate expansion. Consumers in this region are also demanding sustainably sourced and high-quality ingredients, providing opportunities for manufacturers.

Product Segmentation and Applications

Sorbitol is the leading category in sugar alcohol consumption, favored for its bulk sweetening properties and widespread use in cosmetics, food, and pharmaceuticals. Mannitol is anticipated to register the highest growth due to its expanding use in medical and food products. Xylitol is recognized for its dental health benefits and is commonly used in chewing gums, oral care products, and confectionery.

Sugar alcohols are available in various forms, with powdered and crystalline forms dominating due to ease of handling and application. However, liquid and syrup forms are experiencing the fastest growth, driven by their suitability for beverage formulations where dry sweeteners are less applicable.

Food and beverages represent the largest application segment, where sugar alcohols replace conventional sugars in low-calorie and sugar-free products like chocolates, bakery items, spreads, and non-alcoholic drinks. The pharmaceutical segment is also rapidly expanding, leveraging the coating, bulking, and sweetening functions of sugar alcohols in medications.

Challenges and Industry Trends

Despite the promising outlook, some challenges restrain market growth. The comparatively high production costs of sugar alcohols relative to sugar can limit adoption. Additionally, excessive consumption can cause gastrointestinal discomfort in sensitive individuals, and the cooling sensation characteristic of some sugar alcohols is not universally preferred.

Innovations in production technologies, including biotechnological fermentation methods, aim to lower manufacturing costs and environmental impact. Manufacturers are also investing in research to develop diversified applications and improve cost-efficiency.

The trend toward clean-label, natural, and plant-based ingredients remains a significant market driver, influencing product development and consumer acceptance. Moreover, stringent regulations on sugar content in foods and government initiatives promoting reduced sugar intake globally create further growth opportunities.

Conclusion

The global sugar alcohol market stands at a pivotal point of growth, fueled by increasing consumer health awareness and demand for low-calorie sugar substitutes. With its multi-sector applications, strong regional growth prospects, and ongoing innovations in production and formulation, the sugar alcohol market is poised for sustainable expansion through 2033 and beyond. Industry players focusing on cost reduction, product portfolio diversification, and alignment with consumer trends are well-positioned to capitalize on this evolving market landscape.