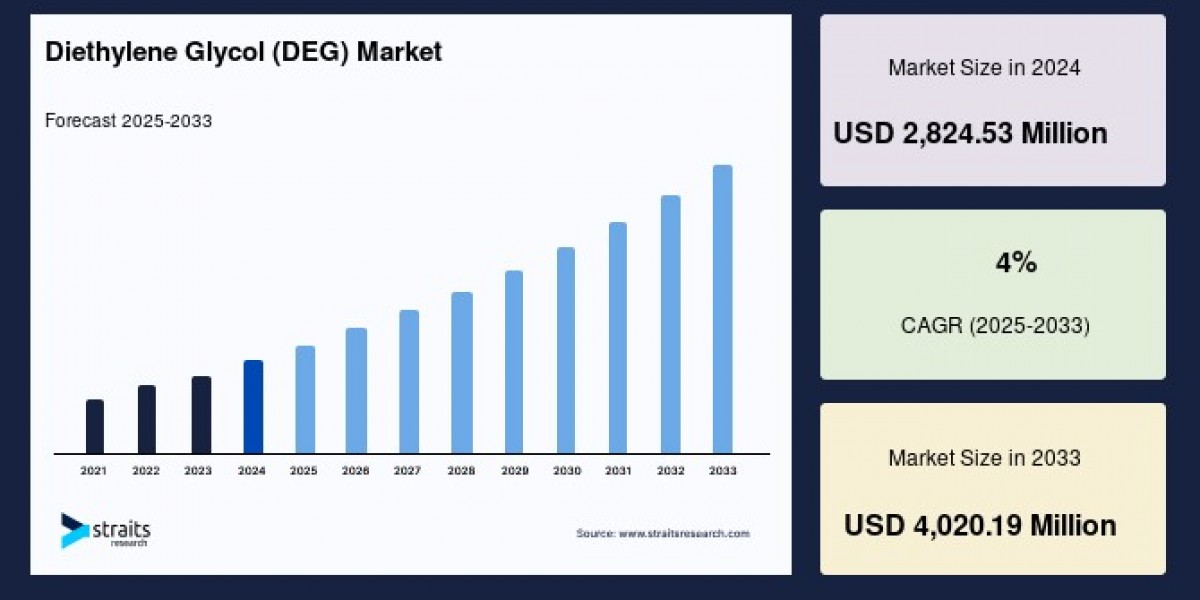

The diethylene glycol (DEG) market size was valued at USD 2,824.53 million in 2024. It is projected to reach from USD 2,937.51 million by 2025 to USD 4,020.19 million by 2033, growing at a CAGR of 4% during the forecast period (2025–2033).

Understanding Diethylene Glycol

Diethylene glycol is an organic chemical commonly produced via the partial hydrolysis of ethylene oxide. It appears as a colorless, viscous liquid with low volatility and a mildly sweet taste. Notably soluble in water, alcohol, acetone, and other organic solvents, DEG is widely utilized both as a solvent and as a raw material integral to the production of plasticizers, thermoplastic polyurethanes, and polyester resins. Its versatility and physical properties enable its extensive use in various industrial applications.

Key Market Drivers

The principal factors propelling the diethylene glycol market encompass urbanization, industrialization, and sectoral growth of end-use industries. Developing nations such as China, India, and Brazil have experienced rapid urban expansion and industrial development, fostering heightened demand for residential and commercial infrastructure. This trend propels the building and construction sector, which in turn elevates the consumption and production of cement. DEG is extensively used as a grinding aid in cement manufacturing to improve fineness and mill efficiency, while also reducing energy usage, thereby making it a critical ingredient within the construction ecosystem.

Similarly, the plastics industry heavily relies on DEG, particularly for producing plasticizers. Flexible PVC products manufactured using DEG-based plasticizers find applications in diverse end-use segments, including pipes, flooring, wall coverings, automotive parts, synthetic leather, and medical equipment. The rising population and improving living standards contribute to growing demand for these flexible PVC products, further stimulating the DEG market.

In the paints and coatings sector, DEG functions as a modifier for alkyd resins, which are essential components in paint formulations. Expansion of the automotive, furniture, and building sectors, especially in emerging economies, has increased the consumption of paints and coatings, thereby boosting demand for DEG.

Market Segmentation and Applications

The diethylene glycol market spans a variety of applications:

Plasticizers dominate usage, driven by strong demand for flexible PVC materials.

Solvents for paint pigments, printing inks, and textile dyes constitute another vital segment.

Chemical intermediates, producing thermoplastic polyurethanes and polyester resins, represent the fastest-growing application area, reflecting automotive and industrial demand.

Freezing point depressants such as antifreeze coolants and heat transfer fluids have seen increased use due to higher automotive production, especially in Asia-Pacific.

Other applications include lubricants, brake fluids, cosmetic and personal care products, and cement grinding aids.

Across industries, plastics contribute the largest market share, with paints and coatings showing the most rapid growth trajectory, given rising industrialization and infrastructure development.

Regional Market Insights

Asia-Pacific prevails as the largest regional market, accounting for the highest revenue share and expanding at an estimated CAGR of 5.2%. This growth is underpinned by the dynamic manufacturing sector in countries like China and India, where technology transfer and favorable labor and raw material costs attract significant automobile and industrial production. Increasing automotive assembly plants in this region intensify demand for related DEG applications such as freezing point depressants.

Europe ranks as the second-largest market and is expected to grow at a CAGR of around 4.5%. Supportive government policies, including subsidies and incentives for the construction industry, fuel demand for DEG in paints and coatings, particularly in countries such as the UK, Germany, and Sweden. The expanding construction activities further underscore this region's relevance.

North America holds the third position by market size, driven largely by construction insulation applications where rigid polyurethane foams—which involve DEG derivatives—play a vital role in energy efficiency for residential and commercial buildings.

Challenges and Regulatory Landscape

Despite promising growth, the DEG market faces certain constraints primarily related to health and safety regulations. Due to its toxicological profile, diethylene glycol is restricted or banned in food and pharmaceutical applications in many jurisdictions. For instance, regulatory limits cap DEG content in polyethylene glycol used as food additives to very low impurity levels. These restrictions can inhibit market expansion in certain segments.

Ongoing regulatory compliance remains crucial for manufacturers to align with environmental and human safety standards. Moreover, companies must navigate investment costs and competitive pressures, necessitating continuous innovation and differentiation.

Innovation and Patent Trends

Intellectual property activity related to DEG has been notable, with patent filings rising significantly from 2016 to 2020 compared to the previous five-year period. China leads globally in patent registrations, reflecting concentrated research and development efforts and extensive industrial usage. This innovation ecosystem catalyzes new derivatives and applications, which are expected to drive market evolution in the coming years.

Future Outlook

The diethylene glycol market is poised for steady growth, buoyed by expanding demand in construction, automotive, and industrial sectors, especially within the Asia-Pacific region. Increased urbanization, rising disposable incomes, and technological advancements will continue to open new application avenues. The push towards sustainability and eco-friendly alternatives may shape product development trajectories moving forward.

Players focusing on sustainable production methods, efficient supply chains, and regulatory adherence will be well positioned to capitalize on emerging opportunities. The trends of rising patent filings and cross-industry collaborations further suggest a dynamic and innovative market environment.

In conclusion, diethylene glycol remains a pivotal chemical intermediate with a broad spectrum of industrial uses. Its growth is closely tied to global industrial trends and evolving sectoral demands, making it a vital material in the contemporary chemical and manufacturing landscape.