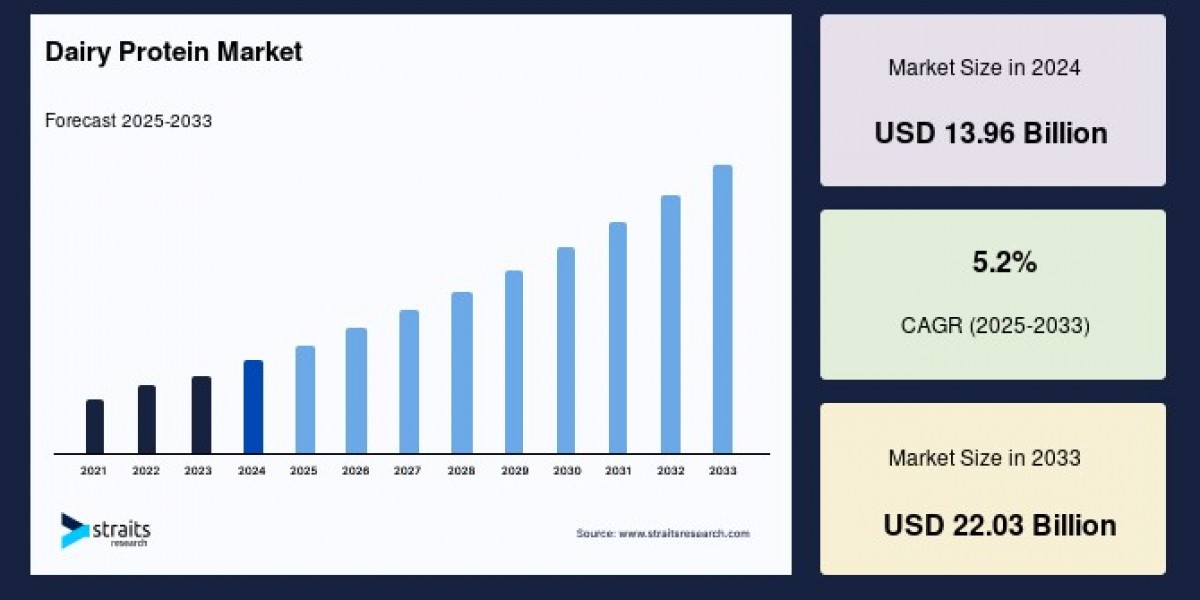

The global dairy protein market size was valued at USD 13.96 billion in 2024 and is projected to reach from USD 14.69 billion in 2025 to USD 22.03 billion by 2033, growing at a CAGR of 5.2% during the forecast period (2025-2033). Whey and casein protein are consumers' most preferred sources of protein supplements, which is likely to drive the demand for the market.

Market Overview

Dairy proteins, which include whey protein, casein, and milk protein concentrates, serve as vital nutritional ingredients extensively used in food products for their functional and bioactive properties. These proteins act as gelling, thickening, carrying, foaming, and texture-modifying agents in various food preparations. Beyond food and beverages, dairy proteins have found increasing uses in animal feed, personal care, cosmetics, textiles, and nutritional supplements.

Whey and casein proteins are the most preferred sources of dietary protein supplements globally, favored for their high nutritional content and their essential roles in muscle building and recovery. This preference is strongly supported by the growing fitness culture and the rising number of health-conscious consumers seeking balanced nutrition and protein-enriched diets.

Drivers of Market Growth

Several factors are propelling the growth of the dairy protein market. A significant driver is the surge in healthcare awareness and fitness trends, especially among younger demographics. Consumers are increasingly adopting diets that emphasize high protein intake to promote overall wellness, muscle growth, and weight management. Protein supplements featuring dairy proteins are viewed as clean-label, natural options with a complete amino acid profile, making them attractive choices amid the growing demand for natural ingredients and functional foods.

Economic growth in emerging markets, particularly in Asia-Pacific, furthers market expansion by increasing disposable incomes and changing dietary habits towards more protein-rich foods and supplements. Additionally, advances in dairy processing technologies have enhanced the purity, functionality, and taste of dairy proteins, enabling manufacturers to develop innovative products for various end-use industries.

The growing preference for vegetarian and plant-based diets among some consumer segments also shapes the market dynamics by increasing demand for dairy proteins as alternatives to meat proteins. However, this trend faces competition from plant-based proteins, which present a restraint, especially as veganism and environmental concerns gain momentum.

Market Segmentation

The dairy protein market can be broadly segmented by type, form, application, and geography.

By Type

Whey Protein: Dominates the market due to its high bioavailability and widespread use in sports nutrition, body-building supplements, and personal care products. Its demand is driven by athlete and fitness communities focused on muscle recovery and energy replenishment.

Casein and Derivatives: Known as slow-digesting proteins, casein proteins are gaining rapid traction in dietary supplements and functional food products. The rising consumption of protein bars, caffeinated drinks, and supplements contributes to this segment's fast growth.

Milk Protein Concentrates: Represent a large share of the market due to their extensive use in infant formulas, bakery products, snacks, and confectionery. Milk protein concentrates are also increasingly popular in skincare and cosmetics for their nutritional benefits.

By Form

Solid Form: Holds a larger market share, favored for its stability, ease of handling, and longer shelf life. Solid dairy proteins include powders used in protein shakes, nutritional bars, and food formulations.

Liquid Form: Expected to be the fastest-growing segment, boosted by the rising consumption of ready-to-drink protein supplements and nutritional beverages. The liquid form is preferred for its convenience and quick absorption, beneficial in healthcare settings such as pre- and post-surgery nutrition.

By Application

Food & Beverages: The largest application segment, driven by the use of dairy proteins in bakery products, snacks, confectionery, dairy products, nutritional bars, and ready-to-eat meals. The consumer shift from convenience foods to healthier, protein-enriched options augments this growth.

Nutrition: The fastest-growing segment fueled by the rising demand for protein supplements and functional nutritional products. Active, health-conscious consumers seeking energy-boosting and muscle-repair solutions contribute to this trend.

Personal Care & Cosmetics: The growing interest in natural and protein-enriched cosmetics has significantly spurred the use of dairy proteins in this sector, especially in emerging markets. The desire to maintain youthful skin and improve hair health is driving demand for dairy protein ingredients in beauty products.

Animal Feed and Others: Dairy proteins also find applications in animal feed for livestock nutrition and other industries such as textiles.

Regional Insights

North America remains the largest revenue contributor in the dairy protein market, supported by its mature dairy industry, high health club membership rates, and widespread consumer awareness regarding the benefits of protein supplements. The United States leads the region with a robust fitness market expanding the demand for protein-rich foods and supplements.

Europe follows next with increasing utilization of milk protein concentrates and whey protein in food and personal care sectors. The region also benefits from growing sports participation and rising demand for refreshment and sports drinks containing dairy proteins.

Asia-Pacific stands out as the fastest-growing region due to rapid urbanization, increasing disposable incomes, and growing awareness about dietary proteins. Major consumers in this region include China, Japan, India, and Australia, with a rising trend toward protein supplements for fitness and nutrition. The expanding dairy industries in these countries also support the production and export of dairy protein concentrates.

Regions like Latin America, the Middle East, and Africa represent emerging markets with untapped potential. Growing healthcare awareness and improving economic conditions present significant opportunities for dairy protein market expansion in these areas.

Challenges and Opportunities

Despite the promising growth prospects, the dairy protein market faces challenges such as rising competition from plant-based protein alternatives, fluctuating raw material costs, and environmental concerns related to dairy farming. Additionally, vegan and lactose-intolerant populations may avoid dairy proteins, posing a limitation to the overall market potential.

However, manufacturers are increasingly investing in research and development to enhance the functionality, taste, and nutritional value of dairy proteins. Innovations such as hydrolyzed proteins, protein blends, and flavor-enhanced formulations are expanding the application scope and consumer acceptance.

The demand for natural, clean-label, and minimally processed dairy proteins also creates opportunities for product differentiation and market segmentation. Furthermore, expanding applications in personal care and cosmetics, alongside energy drinks and specialized nutrition products, offer new avenues for growth.

Conclusion

The dairy protein market is poised for steady growth over the next decade, driven by health-conscious consumers, technological innovations, and expanding applications across multiple industries. With a favorable outlook in fast-growing regions and ongoing product development, dairy proteins will maintain their essential role in the global nutritional and functional food ecosystem.

As consumers continue to seek high-quality protein sources for wellness, performance, and nutrition, dairy proteins are expected to remain preferred options, supported by their versatility, nutritional benefits, and proven efficacy.