Introduction

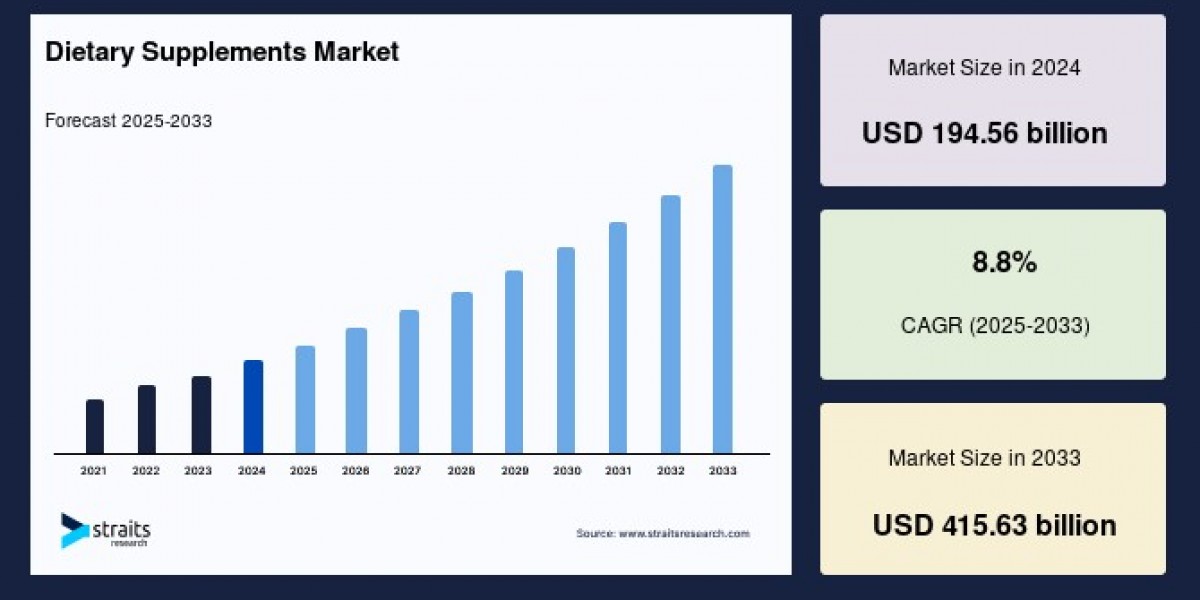

The global dietary supplements market size was valued at USD 194.56 billion in 2024 and is projected to reach from USD 211.68 billion in 2025 to USD 415.63 billion by 2033, growing at a CAGR of 8.80% during the forecast period (2025-2033).

Evolving Consumer Preferences and Innovation

Innovation fuels growth in the global dietary supplements market. Manufacturers are continually evolving product offerings to address specific health needs and preferences, such as immunity, joint health, weight management, and cognitive function. The sector is seeing rising demand for plant-based, vegan, and organic supplement options as consumers gravitate toward clean-label and sustainable products. Delivery formats are being tailored to user convenience, with soft gel pills and gummies gaining popularity for their taste, ease of use, and ability to mask unwanted flavors.

Personalized nutrition represents a significant industry shift, with brands leveraging genetics, lifestyle data, and customer feedback to develop individualized supplement regimens. Companies now offer subscription-based vitamin packs and customized formulas designed to align with personal health goals. The integration of digital platforms and AI-powered analytics enhances the ability to recommend and supply tailored supplements, increasing customer satisfaction and long-term brand loyalty.

Impact of E-Commerce and Digital Trends

Online retailing is rapidly transforming the way dietary supplements are marketed and consumed. Digital platforms offer detailed information, user reviews, and convenient purchasing for consumers, expanding access to a broader audience. The growth of direct-to-consumer brands and subscription services has redefined consumer engagement, making it easier than ever to incorporate supplements into daily routines. Social media influencers and wellness experts play a growing role in shaping purchasing decisions, increasing awareness, and driving product popularity.

Regulatory Landscape and Quality Assurance

As the dietary supplements market expands, regulatory scrutiny has intensified to ensure consumer safety and trust. Regulatory bodies across the globe enforce strict guidelines on manufacturing practices, labeling, permissible ingredients, and health claims. In the United States, the FDA oversees compliance through the Dietary Supplement Health and Education Act and enforces Good Manufacturing Practices. The European Union similarly applies comprehensive rules on safety and labeling. Manufacturers must adhere to these regulations to maintain market access and safeguard reputations, which includes withdrawing products that fail to meet quality or claim standards.

Regional Insights

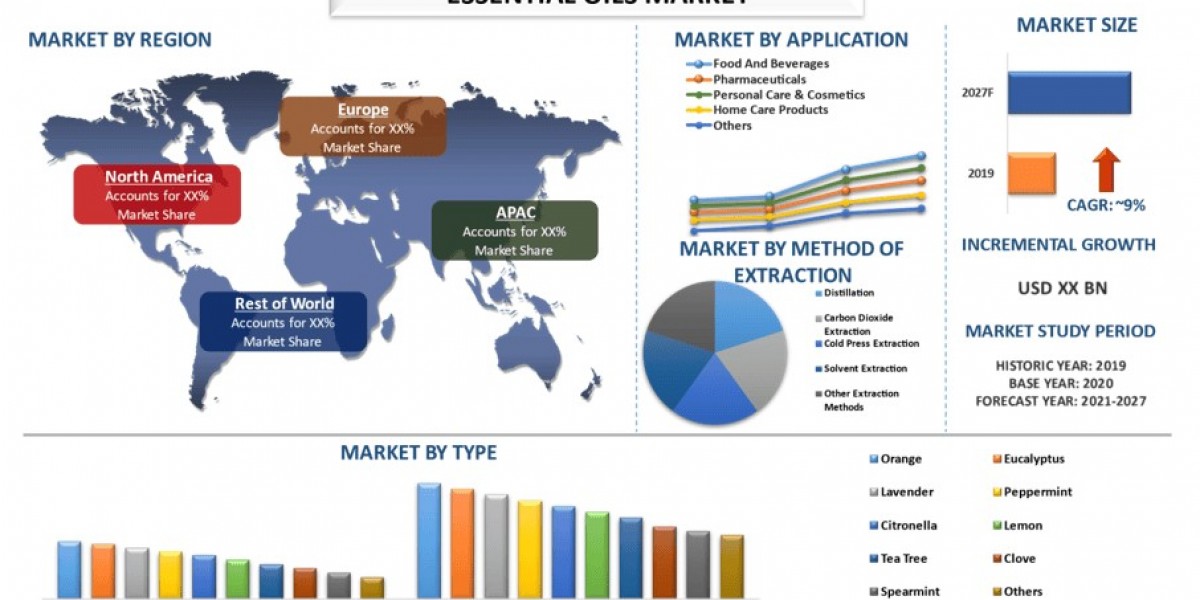

North America maintains its position as the world’s largest dietary supplements market, energized by an established wellness culture, aging population, and robust e-commerce infrastructure. High rates of health awareness, regulatory clarity, and widespread retail access support strong consumer uptake. Asia-Pacific stands out as the fastest-growing region, driven by increased disposable income, growing health consciousness, and the fusion of traditional herbal practices with modern scientific advancements. The region's expanding middle class and aging populations, particularly in China, Japan, and India, contribute to the swelling demand for supplements targeting age-related and lifestyle health concerns. The sector is further bolstered by government initiatives supporting preventive healthcare and rising e-commerce penetration.

Segmentation by Form, Application, and Ingredient

Soft gels and pills dominate the supplement category owing to their ease of use, stability, and precise dosing. The preference for these familiar formats is reinforced by their widespread availability and suitability for sensitive compounds such as omega-3s and fat-soluble vitamins. Powders and liquids, though significant, lag behind due to palatability and convenience factors.

Weight loss remains a primary application, reflecting growing attention to fitness and obesity management. Supplements that promote natural and organic weight control solutions are increasingly in demand as consumers seek safer and more effective alternatives to synthetic products.

Vitamins and minerals lead ingredient categories due to their established importance in supporting immune function, energy metabolism, and overall health. Their popularity is underpinned by consumer familiarity and their wide range of benefits for various age groups and health conditions. Other categories like amino acids, botanicals, and specialty nutrients appeal to niches addressing specific needs such as cognitive health and anti-aging.

Target Demographics and Sales Channels

The women’s segment holds a major share as supplement manufacturers target formulations designed for female-specific health concerns, including prenatal care, menopause, and bone strength. Marketing and product innovations increasingly cater to the distinct nutritional requirements of women.

Pharmacies and drugstores remain the dominant sales channels, valued for professional advice, regulatory compliance, and easy access. However, online channels are surging thanks to convenience, a wider selection, and the integration of digital health solutions. Consumers benefit from being able to research products in depth and make informed decisions at their own pace.

Future Outlook

The dietary supplements market is poised for continued vibrant growth, propelled by personalized solutions, digital transformation, and evolving regulatory frameworks. As health and wellness priorities persist globally, the market is expected to see continued diversification, increased sophistication in product formulation, and enhanced regulatory compliance. Industry stakeholders will need to innovate, adapt to consumer demands, and exceed quality standards to capture new opportunities in this dynamic and competitive arena.