Introduction

The refrigerants market stands at the center of rapid evolution, fueled by industrial advances and shaped by complex environmental imperatives. As the world becomes increasingly urbanized, and industries and households demand more efficient cooling systems, the market for refrigerants has experienced substantial transformation and robust growth projections for the coming years.

Market Overview and Growth Drivers

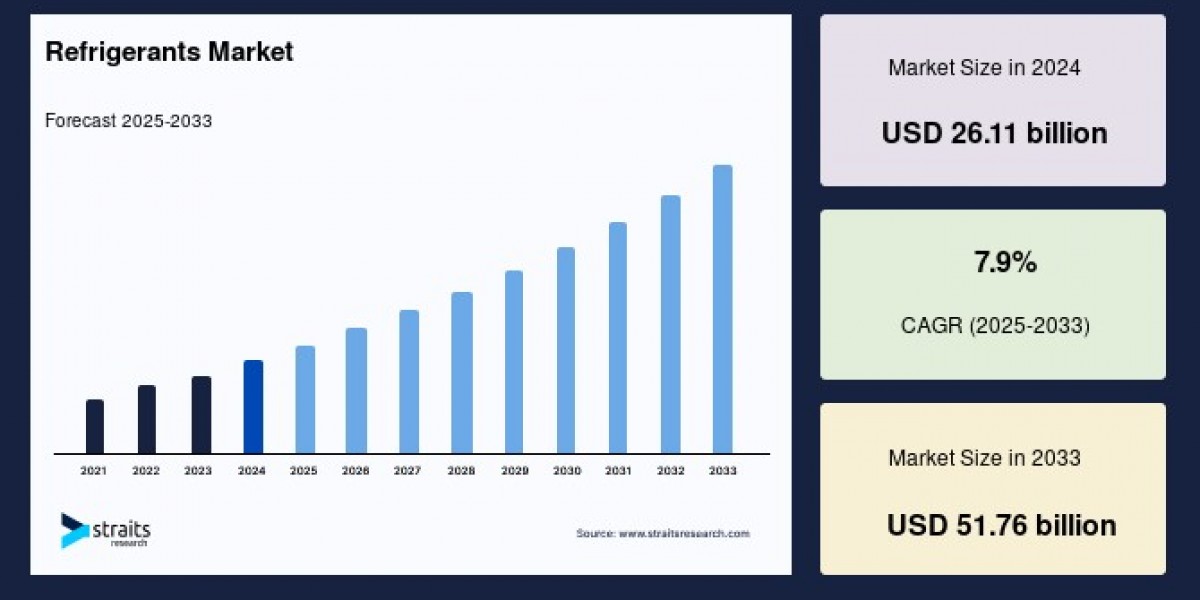

The global Refrigerants Market size was valued at USD 26.11 billion in 2024 and is projected to grow from USD 28.17 billion in 2025 to reach USD 51.76 billion by 2033, growing at a CAGR of 7.9% during the forecast period (2025–2033).

Another pertinent driver is the continued expansion of the automotive and food & beverage sectors. As consumers become more dependent on refrigeration for food safety, pharmaceutical storage, and enhanced comfort in transportation, the demand for efficient refrigerants grows. Simultaneously, flourishing construction in the Asia-Pacific and North American regions fosters greater demand for consumer durables, contributing to market expansion.

Regulatory Landscape and Environmental Pressures

While demand remains robust, the refrigerants market faces substantial challenges arising from regulatory efforts aimed at curbing environmental impacts. Traditionally, many widely used refrigerants such as chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs) have been scrutinized for their ozone depletion potential (ODP) and global warming potential (GWP). Over recent decades, global accords like the Montreal Protocol and its various amendments have set forth guidelines and deadlines for the phase-out of these substances.

The Montreal Protocol has led to the elimination of several chemicals responsible for ozone depletion, setting deadlines for developed and developing countries to phase out harmful refrigerants. More recently, the Kigali Amendment has targeted high-GWP hydrofluorocarbons (HFCs) for gradual phase-out, fostering a global move toward low-impact alternatives.

Product Evolution: The Shift Toward Sustainable Alternatives

This changing regulatory landscape has hastened the development and adoption of alternative refrigerants with lower ODP and GWP. The market is now segmented by product type into categories such as CFCs, HFCs, HCFCs, hydrofluoroolefins (HFOs), carbon dioxide, ammonia, and propane.

HFCs have emerged as replacements for CFCs and HCFCs due to their negligible ODP; yet, concerns about their high GWP have pressed the industry to explore even greener substitutes, such as HFOs and natural refrigerants.

Natural refrigerants like carbon dioxide, ammonia, and propane are gaining traction as industry seeks sustainable solutions. These options offer significant reductions in both ODP and GWP, aligning with global sustainability targets.

The drive for low-GWP alternatives, such as HFO blends and natural refrigerants, demonstrates the commitment of manufacturers and end-users to environmental stewardship while maintaining thermal efficiency.

Application Diversity: Meeting Sector-Specific Needs

Refrigerants play a critical role in a broad array of industries, from transportation and industrial processes to building air conditioning and residential appliances. This diversity of application is critical to the market’s expansion:

Industrial sector: Refrigerants are integral to chiller and HVAC systems used in manufacturing, food processing, pharmaceuticals, and data centers, ensuring precise temperature control.

Commercial sector: Retail, office spaces, and cold storage rely on efficient refrigerant-based systems for food preservation and comfortable indoor environments.

Automotive sector: Air conditioning in vehicles is a major growth avenue, driven by consumer expectations for comfort, especially in developing economies with burgeoning car ownership.

The residential segment also holds a significant market share as air conditioning systems and refrigerators become universal fixtures in homes worldwide. These varying applications ensure that growth in one sector often stimulates further expansion elsewhere in the value chain.

Regional Insights: Asia-Pacific Leads, North America Accelerates

The Asia-Pacific region holds the largest share of the global refrigerants market and is projected for strong, sustained growth. Rapid urbanization, growing middle-class populations, and increasing demand for consumer goods create robust opportunities. Market advances in countries like China, India, Japan, and South Korea are underpinned by higher living standards and new construction.

North America is forecast to register the fastest growth rate, attributed to technical advancements and heightened demand for both comfort cooling and industrial refrigeration. This trend is supported by rising disposable income and the proliferation of air conditioning in residential and commercial sectors. Europe also stands as a significant market, with key drivers including expansion of the food and beverage industry and widespread adoption in commercial refrigeration.

Challenges and Future Prospects

Despite the promise, environmental and safety regulations continue to pose constraints, requiring industry players to invest in research and innovation. The shift away from legacy refrigerants, ongoing regulatory uncertainty, and the high cost of adopting new technologies challenge manufacturers. However, these factors also fuel differentiation and open opportunities for the adoption of environmentally friendly alternatives.

The continued adoption of natural refrigerants, stricter environmental guidelines, and a focus on energy efficiency are set to shape the future market landscape. With ongoing innovation and a commitment to sustainability, the refrigerants market is positioned for dynamic and responsible growth over the coming decade.

Conclusion

The global refrigerants market exemplifies the intersection of industrial growth, regulatory action, and environmental responsibility. As cooling technologies become more integral to society and sustainable practices gain priority, the market is set for notable expansion and rapid evolution offering opportunities and challenges for manufacturers, policymakers, and end-users alike.