The global commercial vehicle market is undergoing significant transformation as electric mobility, autonomous driving, and e-commerce expansion reshape the industry landscape. Fleet operators are increasingly turning to sustainable and digitalized solutions to enhance efficiency, comply with regulations, and meet rising delivery demand. According to Straits Research, the commercial vehicle market is set for steady growth over the coming decade.

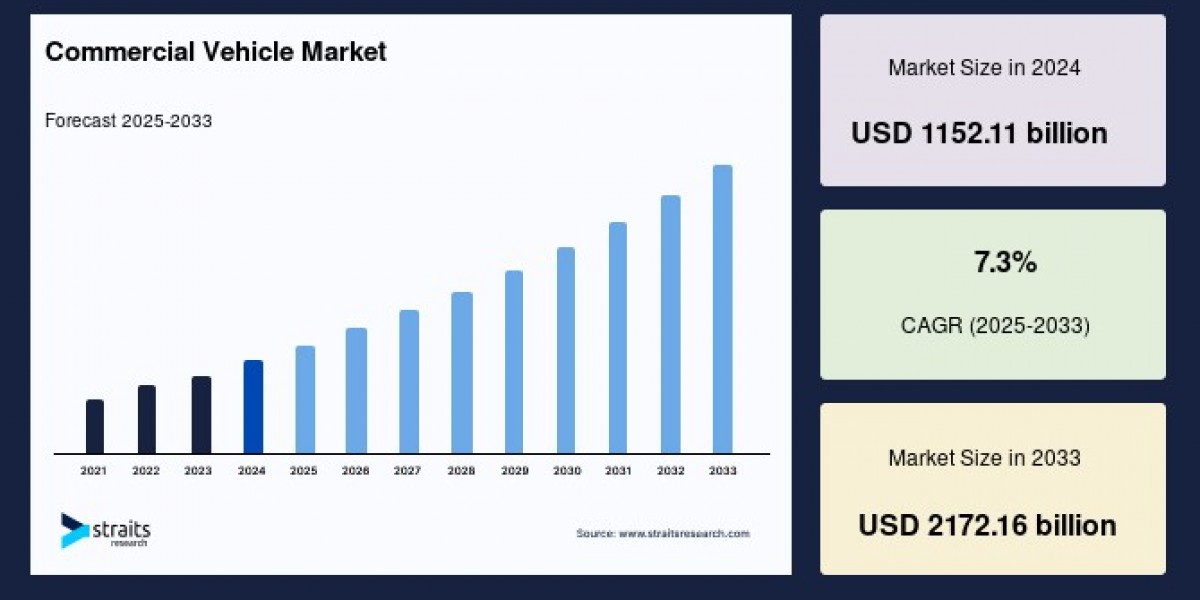

Market Size 2024 – USD 1,152.11 billion

Market Size 2025 – USD 1,236.22 billion

Market Size 2033 – USD 2,172.16 billion

CAGR (2025–2033) – 7.3%

For detailed market data and insights, download free sample here: https://straitsresearch.com/report/commercial-vehicle-market/request-sample

Market Drivers

Rising demand for electric commercial vehicles (ECVs)

Regulatory pressures and corporate sustainability goals are accelerating the shift to electric trucks and vans. Leading OEMs such as Volvo and Daimler are already rolling out electric models to reduce carbon emissions and lower fleet operating costs.

Autonomous driving technology

Self-driving trucks from Tesla, Waymo, and TuSimple are in testing phases, with the potential to reduce labor costs, improve safety, and maximize fleet utilization. As adoption grows, these vehicles will redefine long-haul and urban logistics.

E-commerce boom and last-mile logistics

Explosive growth in online shopping has intensified demand for light commercial vehicles (LCVs). Companies are increasingly adopting electric and autonomous vans to make last-mile deliveries faster and greener.

Market Challenges

High costs of electrification and autonomy

Battery packs make up nearly half of an electric commercial vehicle’s cost, making ECVs significantly more expensive than diesel alternatives. Infrastructure gaps, such as limited charging networks, further hinder adoption.

Volatile fuel and supply chain pressures

Fluctuating diesel prices complicate fleet budgeting, while shortages of semiconductors and critical components delay production of new models.

Optional Impact of Geopolitical Tensions

Conflicts and trade restrictions in manufacturing hubs can disrupt supply chains for raw materials and electronic components. Such disruptions may slow down commercial vehicle production in the short term.

Market Segmentation

According to Straits Research, the commercial vehicle market is segmented by vehicle type, propulsion, and application.

By Vehicle Type

Light Commercial Vehicles (LCVs): Largest share, fueled by urban logistics and last-mile demand

Heavy Commercial Vehicles (HCVs): Crucial for construction, agriculture, and mining

Medium Commercial Vehicles (MCVs): Widely used for regional distribution

By Propulsion

Internal Combustion Engine (ICE): Dominates today’s market but faces gradual decline

Electric Vehicles (EVs): Fastest-growing segment, supported by regulatory mandates and falling battery costs

By Application

Freight and Logistics: Core application, accounting for the majority of vehicle demand

Public Transport: Electric buses and minibuses adopted for sustainable urban transit

To purchase the full report, visit: https://straitsresearch.com/buy-now/commercial-vehicle-market

Top Players Analysis

The competitive landscape is led by established OEMs and innovative new entrants:

Volvo Group – Leader in electric truck development and telematics solutions

Daimler Truck AG – Investing in battery-electric and hydrogen fuel-cell trucks

Tesla, Inc. – Pioneering autonomous trucking with the Tesla Semi

Freightliner (Daimler brand) – Enhancing connected fleet management platforms

Rivian – Targeting last-mile delivery with Amazon-backed electric pickups and vans

Toyota Industries – Expanding presence in commercial mobility solutions

MAN Truck & Bus – Strengthening electrification strategies in Europe

PACCAR Inc. – Innovating across electric and connected trucks

Navistar International – Collaborating on next-gen electric CV development

BYD – Expanding its footprint in electric buses and trucks globally

These companies are advancing electrification, autonomy, and connectivity to gain market share.

Future Outlook

Asia-Pacific is set to become the fastest-growing region, driven by logistics modernization in China and India. Latin America will also see expansion as infrastructure investment accelerates. Meanwhile, North America will retain market leadership due to strong e-commerce, advanced fleet telematics, and strict emissions policies.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. delivers actionable market research data tailored for ROI-driven strategies.

Top FAQs

What is the global commercial vehicle market size in 2025?

The market is expected to reach USD 1,236.22 billion at a CAGR of 7.3%.

Which segment leads by vehicle type?

Light Commercial Vehicles (LCVs) dominate due to surging last-mile delivery demand.

Who are the top electric commercial truck manufacturers?

Volvo Group, Daimler Truck AG, Tesla, and Rivian lead in electric CV innovation.

What challenges hinder electric CV adoption?

High battery costs and lack of charging infrastructure remain major barriers.

How will self-driving trucks impact the market?

They promise reduced labor costs, enhanced road safety, and optimized logistics.