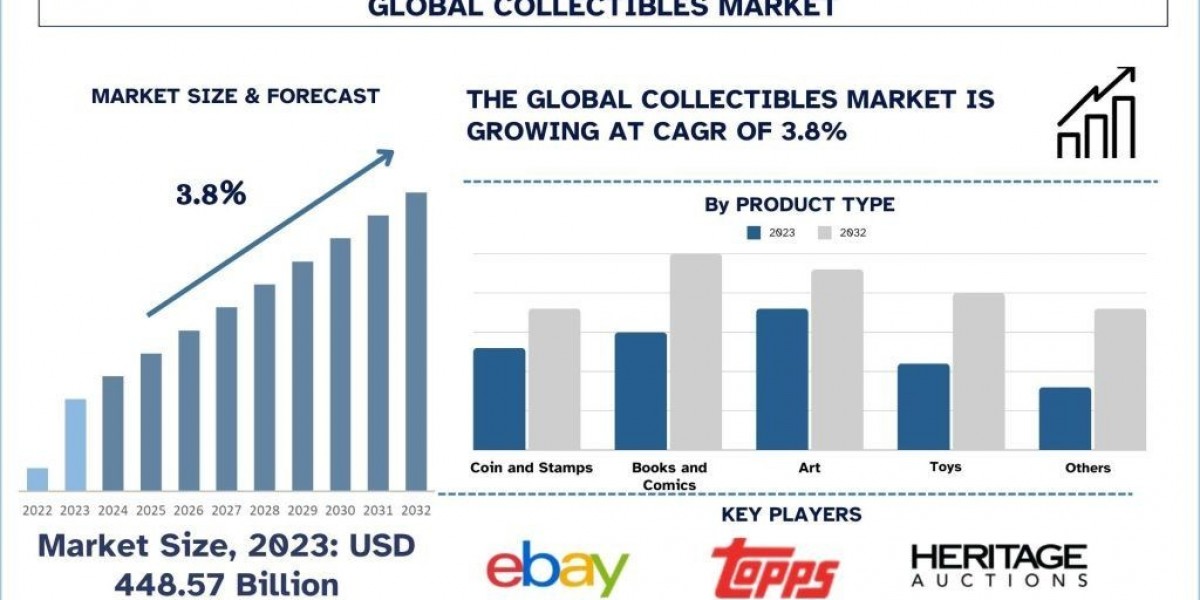

According to the UnivDatos, growing consumer interest in nostalgia and pop culture, increased disposable income among millennials and Gen Z, and the rise of digital platforms and marketplaces that simplify trading and authentication are the major factors driving the growth of the Collectibles market worldwide. As per their “Collectibles Market” report, the global market was valued at USD ~462.82 billion in 2024, growing at a CAGR of about 4.17% during the forecast period from 2025 - 2033 to reach USD billion by 2033.

Collectibles are objects that people desire to possess because they are rare, unique, historically significant, or hold sentimental value. These items could include coins, stamps, and comic books, as well as toys, artwork, trading cards, and digital assets (NFTs). Collectibles are often characterized by nostalgia or investment prospects, and they are generally held in good condition, gaining value over time. They are purchased, sold, or even exchanged using different platforms such as auctions, online, and specialty stores.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/collectibles-market?popup=report-enquiry

The growing interest of consumers in vintage jewellery, vintage cars, and action figure collectibles

The growing interest of the young generation in collecting jewellery and vintage cars is driving the collectible market. Car collecting is a relatively young market compared to other collectibles such as fine art and antique furniture. Antique jewellery, as defined by the United States Customs Service, refers to pieces that are at least 100 years old. However, many jewellery dealers and collectors stretch the term to include the 1920s and 1930s, to show that the product is historical. This term applies to both fine and costume jewellery pieces, with the latter defined as jewellery made from non-precious materials. Furthermore, throughout the ages and across all cultures, humans have used jewellery to denote status. Today, jewellery, including rare watches/timepieces, has become a widely held collectible category. The key factors that always attract the attention of experienced collectors are quality and rarity. The audience for auctions is ever-expanding and fully globalized, with participants from over 100 countries. Collectors are beginning to understand what is really rare, thereby increasing their desire to find these items.

Growing Investments in Luxury items are driving the growth of the Collectibles Market

A luxury collectible is a rare, high-end, or limited-edition item of high value, either because of its craftsmanship, brand, historical significance, or exclusive nature. These are typically sought after by the extremely rich and wealthy due to their exclusivity and potential returns as an investment, as most of these luxury collectibles tend to continue growing spectacularly. Luxury collectibles have gained significant momentum in recent days, as the wealthiest individuals seek an additional investment to diversify their portfolio. Examples of such high-value items are rare watches, vintage cars, fine arts, exclusive wines, designed handbags, and limited-edition jewellery.

Click here to view the Report Description & TOC: https://univdatos.com/reports/collectibles-market

For instance, in June 2024, one rare limited edition watch was sold at auction by Sotheby’s at USD 5.4 million, as it is a timepiece of extraordinary quality, representing the pinnacle of Patek Philippe’s horological mastery.

Rising Investment Appeal and Digital Transformation Fuel Growth in the Global Collectibles Market

The collectibles industry is booming because of escalating household incomes, expansion of digital access, and popular fascination with rare and antique items. With growing interest in other forms of investments, collectibles are emotionally valuable and at the same time have a financial value, making them appealing to both institutional and individual collectors. Digital collectibles, NFTs, and limited-edition releases are emerging trends that are transforming the market and making the world of collecting more engaging and more inclusive. The entry of venture capital, brand associations, and celebrity partnerships is also driving the market's growth. All these developments are not only fueling demand but are also, in turn, justifying the category of collectibles as a valid asset category that can be integrated into diversified investment portfolios.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/