"Executive Summary Europe Tax IT Software Market Research: Share and Size Intelligence

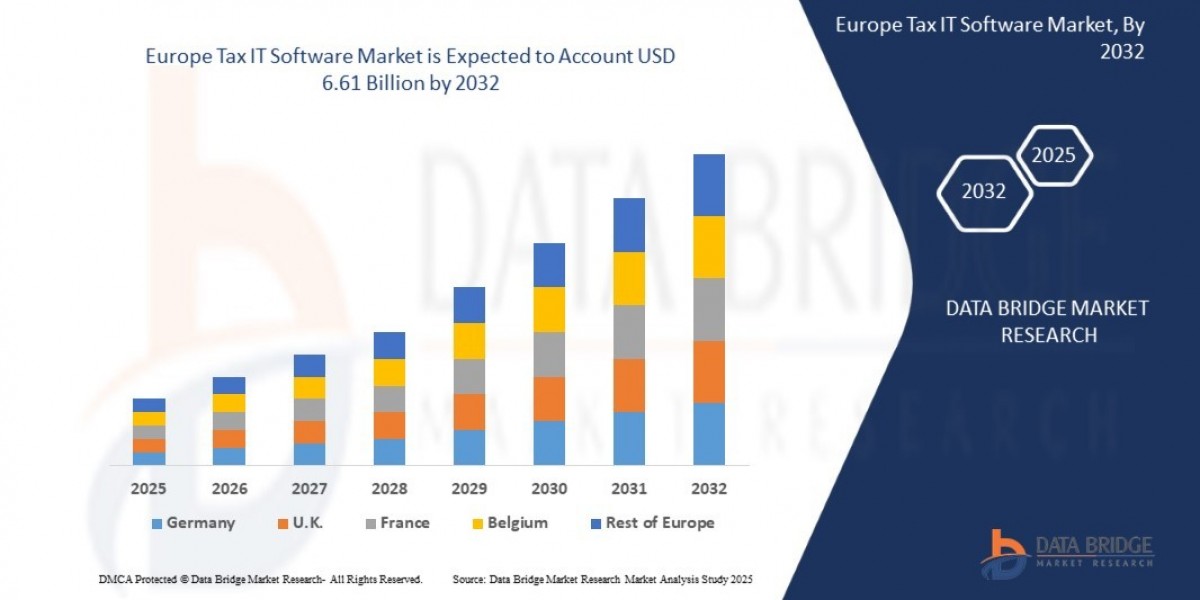

Data Bridge Market Research analyses that the tax the Europe tax IT software market is expected to reach USD 6.61 billion by 2032 from USD 3.88 billion in 2024 growing with a CAGR of 7.0% in the forecast period of 2025 to 2032.

The large scale Europe Tax IT Software Market report gives explanation about the different segments of the market analysis which is demanded by today’s businesses. The process of formulating this market report is initiated with the expert advice and the utilization of several steps. Market share analysis and key trend analysis are the major accomplishing factors of this winning market report. Evaluations of CAGR values, market drivers and market restraints aid businesses in deciding several strategies. Moreover, Europe Tax IT Software Market research report also brings into the focus various strategies that have been used by other key players of the market or Europe Tax IT Software Market industry.

All the statistics covered in the world class Europe Tax IT Software Market report is represented in a proper way with the help of graphs, tables and charts which gives best user experience and understanding. Also, the reviews about key players, major collaborations, merger and acquisitions along with trending innovation and business policies are displayed in this market report. This market study also evaluates the market status, market share, growth rate, sales volume, future trends, market drivers, market restraints, revenue generation, opportunities and challenges, risks and entry barriers, sales channels, and distributors. Europe Tax IT Software Market research report is sure to help businesses in making informed and better decisions thereby managing Market of goods and services.

Find out what’s next for the Europe Tax IT Software Market with exclusive insights and opportunities. Download full report:

https://www.databridgemarketresearch.com/reports/europe-tax-it-software-market

Europe Tax IT Software Market Dynamics

**Segments**

- **By Offering**: On-premise, Cloud-based

- **By Deployment**: Large Enterprises, Small and Medium Enterprises (SMEs)

- **By End-User**: Retail, Healthcare, Manufacturing, BFSI, Others

The Europe Tax IT software market is segmented on the basis of offering, deployment, and end-user. Based on offering, the market is divided into on-premise and cloud-based solutions. On-premise software is installed and operated from a company's in-house server and computing infrastructure, offering more control and customization options. Cloud-based software, on the other hand, is hosted on the vendor's servers and accessed through a web browser, providing flexibility and scalability for businesses. In terms of deployment, the market caters to both large enterprises and small and medium enterprises (SMEs). Large enterprises often require robust and comprehensive tax IT solutions to manage complex operations and reporting requirements, while SMEs may opt for more cost-effective and user-friendly solutions tailored to their specific needs. Furthermore, the market serves various end-user industries such as retail, healthcare, manufacturing, BFSI (banking, financial services, and insurance), and others, each with distinct tax compliance and reporting demands.

**Market Players**

- Oracle Corporation

- SAP SE

- Microsoft Corporation

- Wolters Kluwer N.V.

- Thomson Reuters Corporation

- Avalara, Inc.

- Vertex, Inc.

- Sovos Compliance, LLC

- Ryan, LLC

- TaxSlayer LLC

Key players in the Europe Tax IT software market include Oracle Corporation, SAP SE, Microsoft Corporation, Wolters Kluwer N.V., Thomson Reuters Corporation, Avalara, Inc., Vertex, Inc., Sovos Compliance, LLC, Ryan, LLC, and TaxSlayer LLC. These companies offer a range of tax IT solutions tailored to the diverse needs of businesses across different industries in the European market. With a focus on innovation, strategic partnerships, and continuous product development, these market players strive to enhance their market presence and cater to the evolving tax compliance requirements of organizations in Europe.

The Europe Tax IT software market is witnessing significant growth driven by various factors such as increasing regulatory complexities, the shift towards digitalization, and the need for efficient tax management solutions. One of the key trends shaping the market is the rising adoption of cloud-based tax IT software solutions. Cloud technology offers benefits such as cost-effectiveness, scalability, and remote accessibility, which are particularly advantageous for businesses looking to streamline their tax processes and enhance overall operational efficiency. As more organizations in Europe embrace digital transformation, the demand for cloud-based tax IT solutions is expected to continue to rise, driving market growth.

Another important trend in the Europe Tax IT software market is the growing focus on industry-specific solutions. Different sectors such as retail, healthcare, manufacturing, BFSI, and others have unique tax compliance requirements and reporting obligations. As a result, software providers are developing industry-specific tax IT solutions tailored to meet the specific needs of businesses operating in these sectors. By offering specialized software that addresses industry-specific challenges and regulatory demands, vendors can attract a wider customer base and gain a competitive edge in the market.

Moreover, the market is witnessing increasing competition among key players to enhance their product portfolios and expand their market reach. Companies such as Oracle Corporation, SAP SE, and Microsoft Corporation are investing heavily in research and development to introduce advanced features and functionalities in their tax IT software offerings. Strategic collaborations and partnerships with industry stakeholders are also becoming common strategies to drive innovation and address evolving customer requirements. By leveraging technology advancements such as artificial intelligence, machine learning, and automation, market players are aiming to deliver more efficient, accurate, and user-friendly tax IT solutions that meet the complex needs of businesses operating in Europe.

Furthermore, the Europe Tax IT software market is likely to benefit from the ongoing digital transformation initiatives across the region. As governments and regulatory bodies push for more transparent and standardized tax processes, organizations are increasingly turning to advanced software solutions to ensure compliance and mitigate risks. The demand for tax IT software with real-time reporting capabilities, data analytics tools, and integration with other financial systems is expected to grow as businesses strive to stay ahead of changing regulatory landscapes and tax requirements.

In conclusion, the Europe Tax IT software market is poised for steady growth driven by factors such as cloud adoption, industry-specific solutions, technological advancements, and digital transformation initiatives. As market players continue to innovate and collaborate to meet the evolving needs of businesses in Europe, the landscape is likely to witness further developments and opportunities for growth and expansion.The Europe Tax IT software market is undergoing significant transformations driven by technological advancements and evolving business needs. One of the key drivers of market growth is the increasing adoption of cloud-based solutions across various industries. Cloud technology offers businesses the flexibility, scalability, and cost-effectiveness needed to streamline tax management processes and enhance overall operational efficiency. As more organizations in Europe embrace digitalization, the demand for cloud-based tax IT software solutions is expected to rise, presenting lucrative opportunities for market players to cater to this growing trend.

Moreover, the market is witnessing a trend towards industry-specific tax IT solutions tailored to meet the unique compliance requirements and reporting obligations of different sectors such as retail, healthcare, manufacturing, BFSI, and others. By offering specialized software designed for specific industries, vendors can address the distinct challenges faced by businesses in these sectors and gain a competitive edge in the market. This trend underscores the importance of customization and flexibility in tax IT solutions to meet the diverse needs of organizations operating in different industries.

Furthermore, intense competition among key players in the Europe Tax IT software market is driving continuous innovation and collaboration within the industry. Companies are investing in research and development initiatives to enhance their product portfolios and introduce advanced features such as artificial intelligence, machine learning, and automation in their solutions. Strategic partnerships and collaborations with industry stakeholders are also becoming common strategies to drive innovation and address evolving customer requirements. By focusing on technological advancements and customer-centric solutions, market players aim to stay ahead of the competition and cater to the changing needs of businesses in Europe.

Additionally, the digital transformation initiatives led by governments and regulatory bodies in Europe are creating opportunities for the adoption of advanced tax IT software solutions. Organizations are increasingly turning to technology-driven solutions to ensure compliance with regulatory requirements, enhance transparency in tax processes, and mitigate risks associated with non-compliance. The demand for tax IT software with real-time reporting capabilities, data analytics tools, and seamless integration with financial systems is expected to grow as businesses seek to navigate complex regulatory landscapes and stay abreast of evolving tax requirements.

In conclusion, the Europe Tax IT software market is set for continuous growth and evolution driven by factors such as cloud adoption, industry-specific solutions, technological advancements, and digital transformation initiatives. Market players are well-positioned to capitalize on these trends by offering innovative and tailored solutions to address the diverse needs of businesses across different sectors. As the market landscape continues to evolve, collaborations, strategic partnerships, and a focus on customer-centric offerings will be crucial for sustained growth and competitiveness in the Europe Tax IT software market.

Track the company’s evolving market share

https://www.databridgemarketresearch.com/reports/europe-tax-it-software-market/companies

Master List of Market Research Questions – Europe Tax IT Software Market Focus

- What is the size of the Europe Tax IT Software Market based on the latest report?

- How is the market expected to grow annually?

- Which components make up the primary segmentation?

- Who are the most influential firms in the current landscape?

- What are some recent product or service launches?

- Which countries are covered in the scope of the Europe Tax IT Software Market report?

- What region is demonstrating the highest Europe Tax IT Software Market momentum?

- Which country will likely dominate future trends for Europe Tax IT Software Market?

- Which area leads in terms of Europe Tax IT Software Market occupancy?

- Which country holds the top position for CAGR?

Browse More Reports:

Global Blood Meal for Swine Market

Spain Machine Learning as a Service Market

Global Organic Fruits and Vegetables Market

Global Thermocouple Temperature Sensors Market

North America Drug-Device Combination Market

Global Oropharyngeal Cancer Market

Europe Color Concentrates Market

Europe Laparoscopic Instruments Market

Netherlands Advanced Wound Care Market

Global Electrical and Electronics Ceramics Market

Global Industrial Lubricants Market

North America Fall Protection Market

Global Ophthalmology Market

Global Pyrolysis Oil Market

Global Flexible Dairy Packaging Market

U.S. Human Leukocyte Antigen (HLA) Typing Transplant Diagnostics Services Market

Global High-Performance Adhesives Market

Global Rickets Market

Global Field Mapping Precision Farming Market

Global Angiotensin Converting Enzyme (ACE) Inhibitors Market

Global Diabetes Care Devices Market

Europe Capric/Caprylic Triglycerides Market

Middle East and Africa Neurosurgery Market

Global Needle Biopsy Market

Global Health Cybersecurity Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com