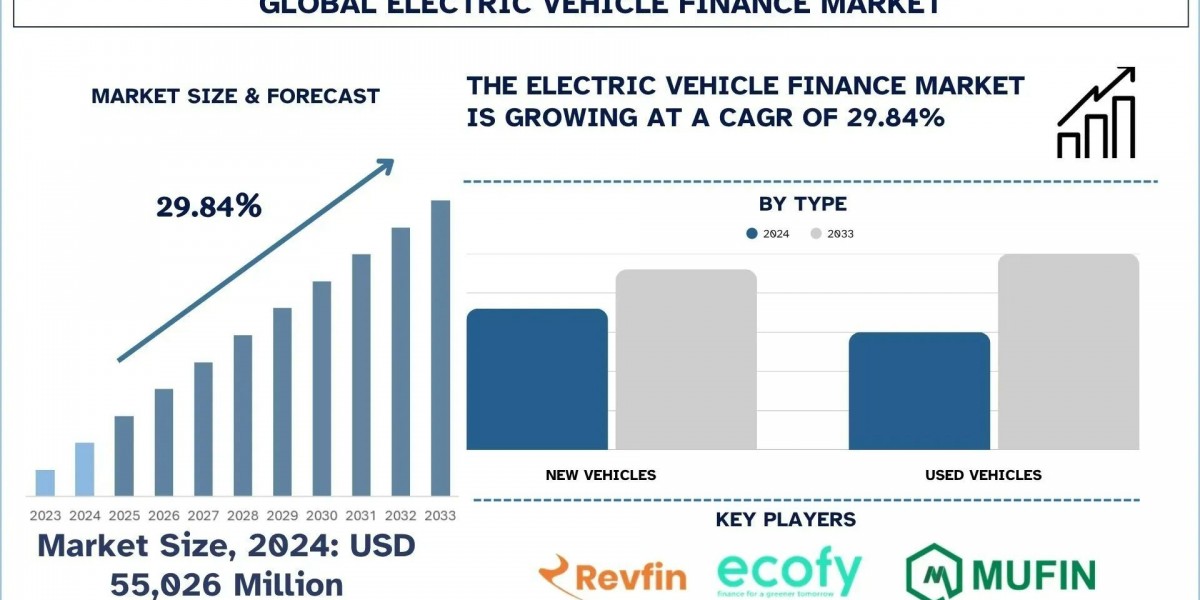

According to a new report by UnivDatos, the Electric Vehicle Finance Market is expected to reach USD million in 2033 by growing at a CAGR of 29.84%. The EV finance market has been expanding due to several factors, including growing EV demand, favorable policies, and innovative financing services. Governments provide subsidies, low-interest loans, tax incentives, and regulatory requirements that increase the purchase of EVs as well as the access to funds. Finance companies are developing EV loan-related products that are more convenient (eg, lease-to-own) and scalable (eg, commercial EV lending). Moreover, the digitalization of the finance process further enhances the EV finance market.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/electric-vehicle-finance-market?popup=report-enquiry

Rising EV adoption

A significant market driver influencing the market demand for EV financing is the increasing sales of electric vehicles (EVs). For instance, according to the International Energy Agency's 2023 stats, the electric car sales in 2023 were 3.5 million higher than in 2022, which is a 35% year-on-year increase. This growing demand for EVs is accelerating the need to have supportive financing services that can assist consumers in purchasing EVs. To reduce the costs of EVs, governments across the world are giving great incentives like tax credits, subsidies, lower registration rates, and exemption from toll payments. There are various types or models of EVs being introduced by Original Equipment Manufacturers (OEMs) at various price ranges, thus making them accessible to more consumers. The demand for EVs is rising, and along with it, the need for simple and affordable ways to finance their upfront costs. Financial institutions, OEMs, and fintech companies are continuously coming up with customized EV financing products, such as green loans, lease-to-own schemes, and battery-as-a-service subscriptions. This combination of increasing demand for EVs, coupled with favorable financing schemes, is pushing the overall EV market to grow rapidly.

Click here to view the Report Description & TOC https://univdatos.com/reports/electric-vehicle-finance-market

According to the report, the Asia-Pacific region holds the largest market share in the Global Electric Vehicle Finance Market

The global EV finance market is dominated by the Asia-Pacific region, fuelled by high levels of government support, robust electric vehicle adoption, and growing participation from financial institutions. Countries such as China and India provide high subsidies and tax promotion, not only in the purchase of EVs, but also in financing and leasing schemes. For instance, in an attempt to promote the use of electric vehicles, the Government of India launched the second phase of "Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles" in 2019. The project will cover the time frame of 5 years, and it is a budget-supported project worth INR 10,000 Cr. The primary focus of this initiative is on electrifying public and shared transportation, with the aim of providing subsidies for 7262 e-Buses, 1.6 lakh e-3 Wheelers, 30461 e-4 Wheeler Passenger Cars, and 15 lakh e-2 Wheelers.

Adding to this, the banks, NBFCs, and OEMs of the region have initiated personalized financing offers and services like low-interest loans, flexible tenure, and leasing of batteries to lower the initial costs. Moreover, an increasing number of alliances between auto companies and fintech businesses have widened the reach of digital EV financing and made their adoption widely significant and prominent.

Related Report:-

India Personal Loan Market: Current Analysis and Forecast (2025-2033)

Private Pension Insurance Market: Current Analysis and Forecast (2025-2033)

Mexico Private Equity Market: Current Analysis and Forecast (2025-2033)

India Buy Now Pay Later Market: Current Analysis and Forecast (2025-2033)

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/