"Executive Summary Tax Tech Market :

CAGR Value

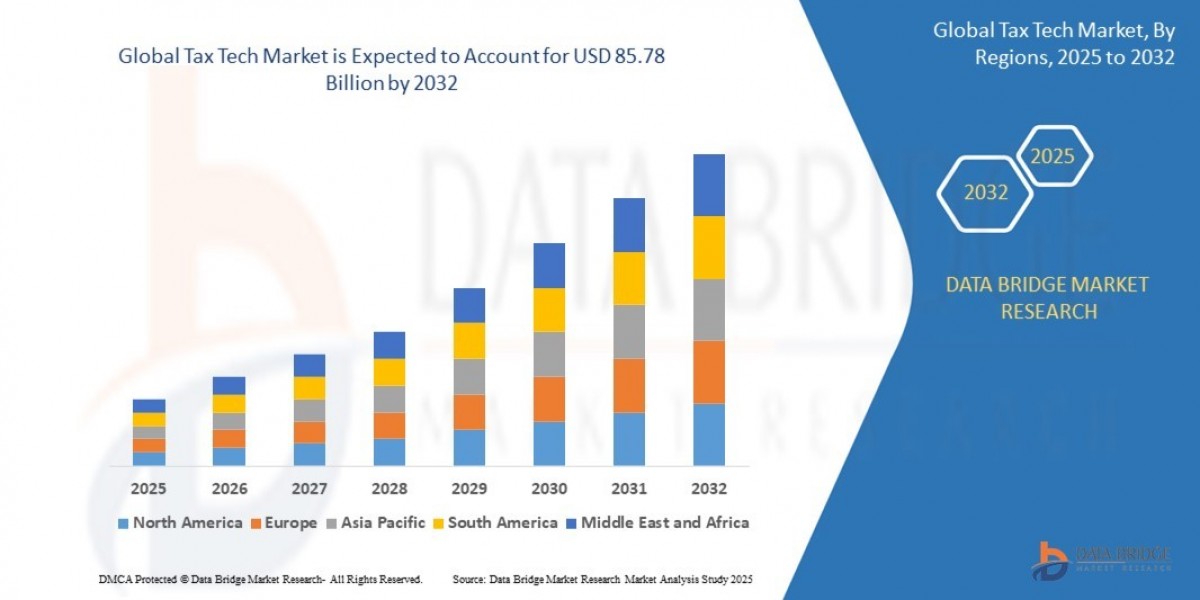

The global tax tech market size was valued at USD 34.4 billion in 2024 and is expected to reach USD 85.78 billion by 2032, at a CAGR of 12.10% during the forecast period

This Tax Tech Market research report is a proven and consistent source of information which gives telescopic view of the existing market trends, emerging products, situations and opportunities that drives your business towards the success. Market segmentation studies conducted in this report with respect to product type, applications, and geography are valuable in taking any verdict about the products. Tax Tech Market report also provides company profiles and contact information of the key market players in the key manufacturer’s section. Gaining valuable market insights with the new skills, latest tools and innovative programs is sure to help your business achieve business goals.

The Tax Tech Market report provides CAGR value fluctuations during the forecast period of 2018-2025 for the market. It encompasses a methodical investigation of current scenario of the global market, which covers several market dynamics. The report provides wide-ranging statistical analysis of the market’s continuous positive developments, capacity, production, production value, cost/profit, supply/demand and import/export. No stone is left unturned while researching and analysing data to prepare market research report like this one and the others. To get knowledge of all the above factors, this Tax Tech Market report is created that is transparent, extensive and supreme in quality.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Tax Tech Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-tax-tech-market

Tax Tech Market Overview

**Segments**

- **Type:** The global tax tech market can be segmented based on type into tax management, tax planning, tax filing, and others. Tax management software helps organizations streamline tax processes, ensure compliance with regulations, and minimize risks. Tax planning software assists in developing effective tax strategies to optimize financial resources. Tax filing software automates the preparation and submission of tax returns, enhancing efficiency and accuracy.

- **Deployment:** The market can also be segmented by deployment mode, including cloud-based and on-premises solutions. Cloud-based tax tech offers scalability, flexibility, and cost-effectiveness by enabling access from anywhere with an internet connection. On-premises solutions provide greater control over data and security for organizations with specific compliance requirements.

- **Organization Size:** Furthermore, the market can be segmented based on organization size into small and medium-sized enterprises (SMEs) and large enterprises. SMEs benefit from tax tech solutions that are tailored to their budget and operational needs, helping them compete with larger players. Large enterprises leverage advanced tax tech tools to manage complex tax systems, multiple entities, and global operations effectively.

- **End-User:** The global tax tech market can be segmented by end-user industry, including BFSI, IT and telecommunications, healthcare, retail, manufacturing, and others. Each industry has unique tax requirements and challenges, requiring specialized tax tech solutions to ensure compliance, minimize tax liabilities, and drive financial performance.

**Market Players**

- **Avalara, Inc.:** Avalara offers a comprehensive suite of cloud-based tax compliance solutions for businesses of all sizes, helping them automate and manage indirect tax processes efficiently.

- **Thomson Reuters:** Thomson Reuters provides tax technology solutions that enable tax professionals to streamline workflows, manage data effectively, and ensure compliance with changing tax regulations globally.

- **Wolters Kluwer:** Wolters Kluwer offers tax and accounting software solutions designed to enhance accuracy, efficiency, and productivity for tax professionals and organizations.

- **Intuit Inc.:** Intuit’s tax tech solutions, such as TurboTax, QuickBooks, and ProConnect, cater to individuals, small businesses, and accounting professionals, simplifying tax preparation and compliance.

- **Vertex, Inc.:** Vertex provides tax technology and services that enable companies to automate and centralize tax processes, optimize tax planning, and mitigate risks across jurisdictions.

The global tax tech market is witnessing significant growth driven by increasing regulatory complexity, digital transformation, and the need for operational efficiency in tax management. Businesses across industries are adopting tax tech solutions to streamline processes, reduce manual errors, and gain real-time insights into their tax obligations. As the market continues to evolve, players like Avalara, Thomson Reuters, Wolters Kluwer, Intuit Inc., and Vertex, Inc. are innovating to meet the diverse needs of organizations worldwide, driving the adoption of advanced tax technology solutions.

The global tax tech market is experiencing a revolution in terms of technological advancements and the integration of tax solutions across various industries. With the digital transformation wave sweeping through organizations globally, the demand for efficient, automated, and compliant tax solutions is soaring. Tax technology is no longer a discretionary tool but a strategic necessity for organizations looking to stay ahead in a highly competitive market landscape. The evolution of tax tech solutions has shifted the focus from mere tax compliance to proactive tax management, planning, and optimization.

One key trend shaping the global tax tech market is the rise of AI and machine learning in tax software. These technologies are enabling tax professionals to automate repetitive tasks, analyze vast amounts of data for insights, and enhance decision-making processes. AI-driven tax tech solutions are providing organizations with predictive analytics capabilities to forecast tax implications, identify potential risks, and capitalize on tax-saving opportunities. As tax regulations become more complex and dynamic, AI-powered tax technology is proving to be a game-changer in ensuring accuracy and compliance.

Another significant trend in the tax tech market is the increasing emphasis on data security and privacy. With sensitive financial information being processed and stored in tax software, organizations are prioritizing robust cybersecurity measures to safeguard against potential cyber threats and data breaches. Tax tech vendors are integrating advanced encryption technologies, multi-factor authentication, and secure data storage protocols to instill confidence in their customers regarding data protection and regulatory compliance.

Furthermore, the COVID-19 pandemic has accelerated the adoption of cloud-based tax tech solutions. The remote work paradigm has highlighted the importance of cloud technology in enabling seamless collaboration, accessibility, and scalability for tax processes. Cloud-based tax tech solutions offer scalability, real-time updates, and data accessibility from anywhere, making them indispensable for organizations operating in a distributed workforce model. As businesses strive to optimize operations and adapt to a rapidly changing business environment, cloud-based tax tech solutions are becoming the preferred choice for agility and efficiency.

In conclusion, the global tax tech market is witnessing a transformative period driven by technological innovation, regulatory changes, and changing business dynamics. The integration of AI, cloud technology, and cybersecurity measures is reshaping the way organizations manage their tax functions, paving the way for more strategic and efficient tax operations. As businesses continue to navigate through evolving tax landscapes, the role of tax tech solutions provided by industry leaders like Avalara, Thomson Reuters, Wolters Kluwer, Intuit Inc., and Vertex, Inc. will remain paramount in driving operational excellence, compliance, and competitive advantage.The global tax tech market is experiencing a profound transformation as technological advancements and digitalization revolutionize the tax landscape across industries. One emerging trend that is shaping the market is the increasing integration of AI and machine learning into tax software solutions. These technologies are enabling tax professionals to automate tasks, analyze extensive datasets for valuable insights, and improve decision-making processes. AI-powered tax tech solutions are providing predictive analytics capabilities that help organizations forecast tax implications, mitigate risks, and capitalize on tax-saving opportunities. This shift from traditional tax compliance to proactive tax management is enhancing operational efficiency and strategic decision-making for businesses globally.

Another notable trend in the tax tech market is the heightened focus on data security and privacy. With the surge in cyber threats and data breaches, organizations are prioritizing robust cybersecurity measures to protect sensitive financial information stored in tax software. Tax tech vendors are incorporating advanced encryption technologies, multi-factor authentication, and secure data storage protocols to ensure data protection and regulatory compliance. The emphasis on data security is crucial in fostering trust among customers and stakeholders, especially in an era where data privacy regulations are becoming more stringent.

Furthermore, the COVID-19 pandemic has accelerated the adoption of cloud-based tax tech solutions. The shift to remote work has underscored the importance of cloud technology in enabling seamless collaboration, accessibility, and scalability for tax processes. Cloud-based tax tech solutions offer real-time updates, scalability, and data accessibility from anywhere, making them indispensable for organizations operating in a distributed workforce model. As businesses strive to optimize operations and adapt to a dynamic business environment, cloud-based tax tech solutions are becoming the preferred choice for agility and efficiency.

In conclusion, the global tax tech market is evolving rapidly, driven by technological innovation, regulatory complexities, and changing market dynamics. The convergence of AI, cloud technology, and cybersecurity measures is reshaping how organizations manage their tax functions, leading to more strategic and efficient tax operations. As businesses navigate through evolving tax landscapes, the role of tax tech solutions provided by industry leaders such as Avalara, Thomson Reuters, Wolters Kluwer, Intuit Inc., and Vertex, Inc. will be instrumental in driving operational excellence, regulatory compliance, and competitive advantage in the increasingly complex and competitive business environment.

The Tax Tech Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-tax-tech-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

What insights readers can gather from the Tax Tech Market report?

- Learn the behavior pattern of every Tax Tech Market-product launches, expansions, collaborations and acquisitions in the market currently.

- Examine and study the progress outlook of the global Tax Tech Marketlandscape, which includes, revenue, production & consumption and historical & forecast.

- Understand important drivers, restraints, opportunities and trends (DROT Analysis).

- Important trends, such as carbon footprint, R&D developments, prototype technologies, and globalization.

Browse More Reports:

Global Stereotactic Surgery Market

Asia-Pacific Water Sink Market

Global Feed Palatability Enhancers and Modifiers Market

Global Laboratory Informatics Market

Global PET Cups Market

Global Handheld Intraoral Dental 3D Scanners Market

Global Polycystic Ovarian Syndrome (PCOS) Market

Global Fatty Acid Esters Market

Europe Water Sink Market

Global Finger Splint Market

Global Vitamin - Mineral Premixes Market

North America Handheld Intraoral Dental 3D Scanners Market

Global Primary Petrochemicals Market

Global Benzene and Its Derivatives Market

Global Vehicle Motorized Door Market

Global Fragrance Diffuser Market

Global Cosmetic Surgery and Services Market

Global Ammonium Nitrate Market

Middle East and Africa Foundry Chemicals Market

Global Cannabidiol (CBD) Tea Market

Indonesia Talc Market

Global Edutainment Market

Global Cold Chain Tracking and Monitoring Market

LATAM RFID Tags Market

Global Check Rails Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"