"Executive Summary Tax Tech Market :

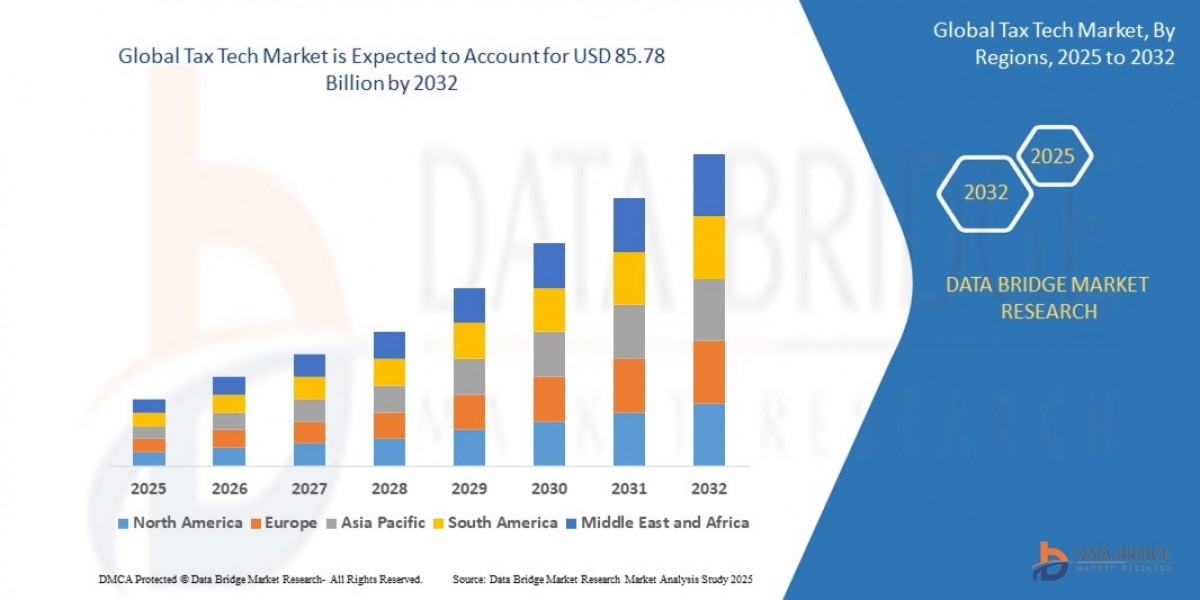

The global tax tech market size was valued at USD 34.4 billion in 2024 and is expected to reach USD 85.78 billion by 2032, at a CAGR of 12.10% during the forecast period

Tax Tech Market report has CAGR value fluctuations during the forecast period of 2018-2025 for the market. The report consists of remarkable data, present market trends, market environment, technological innovation, upcoming technologies and the technical progress in the related industry. The report is an entire background analysis of the industry which includes an estimation of the parental market. Consequently, for better decision making and thriving business growth, data and information covered in this market report is very imperative. Tax Tech Market report contains information about historic data, present market trends, environment, technological innovation, upcoming technologies and the technical progress in the related industry.

In this Tax Tech Market report, market is well analyzed on the basis of various regions. This report uses SWOT analysis technique for an assessment of the development of the most remarkable market players. For attaining the success at local, regional as well as international level, this high quality global market research report is a definitive solution. The data and information about industry are taken from reliable sources such as websites, annual reports of the companies, and journals, and then validated by the market experts. The Tax Tech Market report is provided with the powerful insights and data that helps outshine the competition.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Tax Tech Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-tax-tech-market

Tax Tech Market Overview

**Segments**

- **By Offering**: The Global Tax Tech Market can be segmented based on offering into software and services. The software segment is further divided into cloud-based and on-premises solutions. With the increasing adoption of cloud technology, cloud-based tax tech solutions are gaining significant traction in the market due to their scalability, flexibility, and cost-effectiveness. On the other hand, services such as consulting, implementation, and support are essential for the successful deployment and utilization of tax tech solutions.

- **By Tax Type**: Tax tech solutions cater to various tax types, including income tax, sales tax, value-added tax (VAT), corporate tax, and others. Each tax type has its complexities and requirements, driving the demand for specialized tax tech solutions tailored to meet specific compliance and reporting needs. Income tax management solutions, for instance, help businesses streamline their income tax processes, ensure compliance with tax laws, and optimize tax planning strategies.

- **By Deployment Mode**: Tax tech solutions are deployed either on-premises or in the cloud. The choice of deployment mode depends on factors such as data security, scalability, and accessibility. While on-premises deployments offer greater control over data and systems, cloud-based deployments provide the advantage of remote access, automatic updates, and reduced infrastructure costs. Hybrid deployments combining both on-premises and cloud elements are also gaining traction in the market.

- **By End-User**: The Global Tax Tech Market serves various end-user industries, including BFSI (Banking, Financial Services, and Insurance), IT and Telecom, Retail, Healthcare, Manufacturing, and others. Each industry has specific tax requirements and regulations that drive the adoption of tax tech solutions tailored to their unique needs. For example, the BFSI sector requires robust tax compliance solutions to navigate complex financial transactions and regulatory changes effectively.

**Market Players**

- **Thomson Reuters Corporation**: A leading provider of tax tech solutions, Thomson Reuters offers a wide range of software and services to help businesses streamline tax processes, ensure compliance, and optimize tax planning strategies. With a global presence and strong industry expertise, Thomson Reuters is a prominent player in the Global Tax Tech Market.

- **Wolters Kluwer NV**: Wolters Kluwer NV is another key player in the tax tech market, offering innovative tax software solutions to enable effective tax management, reporting, and analysis. Its comprehensive suite of tax tech products caters to the diverse needs of businesses across different industries, empowering them to meet regulatory requirements and drive operational efficiency.

- **Avalara, Inc.**: Avalara is a prominent player specializing in cloud-based tax compliance solutions, helping businesses automate and streamline their tax processes. Its cutting-edge tax tech platform simplifies tax calculation, filing, and reporting, enabling organizations to achieve greater accuracy and efficiency in managing their tax responsibilities.

- **Vertex, Inc.**: Vertex is a leading provider of tax technology solutions, offering advanced tax calculation and reporting tools to support businesses in managing complex tax requirements. With a focus on innovation and customer satisfaction, Vertex continues to expand its presence in the Global Tax Tech Market by delivering value-added solutions to enhance tax operations.

- **Sovos Compliance, LLC**: Sovos Compliance is a trusted partner for tax compliance and reporting solutions, serving businesses of all sizes with its comprehensive tax tech offerings. From VAT compliance to e-invoicing and regulatory reporting, Sovos helps organizations simplify tax complexities and minimize risks associated with non-compliance.

For more insights and detailed analysis, refer to: The global tax tech market is witnessing significant growth and evolution driven by factors such as increasing regulatory complexities, digital transformation initiatives, and the continuous need for organizations to optimize tax processes and compliance. One emerging trend in the market is the integration of artificial intelligence (AI) and machine learning (ML) capabilities into tax tech solutions. These technologies enable advanced data analytics, predictive modeling, and automation of repetitive tasks, enhancing the accuracy and efficiency of tax operations. By leveraging AI and ML algorithms, businesses can gain valuable insights, improve decision-making processes, and proactively address tax-related challenges.

Another key aspect shaping the market is the emphasis on cybersecurity and data privacy within tax tech solutions. As organizations handle vast amounts of sensitive financial data and tax information, ensuring robust security measures and compliance with stringent privacy regulations is imperative. Tax tech providers are increasingly focusing on enhancing cybersecurity protocols, implementing encryption techniques, and adopting secure cloud infrastructure to safeguard client data against cyber threats and breaches. The rising awareness of data security risks is driving the demand for tax tech solutions with robust protection mechanisms integrated into their offerings.

Moreover, the market is witnessing a shift towards customized and industry-specific tax tech solutions to meet the diverse needs of different sectors. As industries such as BFSI, healthcare, retail, and manufacturing face unique tax challenges and regulations, there is a growing demand for tailored tax tech solutions that address specific industry requirements. Providers are developing specialized modules, compliance frameworks, and reporting tools designed to cater to the distinct tax landscapes of various sectors, thereby enhancing operational efficiency and regulatory compliance for businesses operating in these industries.

Furthermore, the increasing globalization of business operations and cross-border transactions is fueling the demand for multi-jurisdictional tax tech solutions. As organizations expand their presence internationally, they encounter complex tax regulations, transfer pricing issues, and cross-border compliance challenges that require sophisticated tax technology capabilities. Providers offering global tax management platforms with localization features, multi-language support, and real-time updates on regulatory changes are gaining traction among multinational enterprises seeking comprehensive tax solutions to navigate the complexities of global tax environments.

In conclusion, the global tax tech market is undergoing significant transformations driven by technological advancements, regulatory dynamics, and evolving business landscapes. As organizations prioritize efficiency, compliance, and strategic tax planning, the demand for innovative tax tech solutions will continue to rise. By embracing emerging technologies, strengthening cybersecurity measures, tailoring solutions to industry-specific needs, and addressing global tax challenges, market players can enhance their competitiveness and effectively meet the evolving demands of modern tax environments.The Global Tax Tech Market is a dynamic landscape characterized by the increasing adoption of cloud-based solutions, the diversification of tax types catered to, the choice between on-premises and cloud deployments, and the unique needs of various end-user industries such as BFSI, IT and Telecom, Retail, Healthcare, and Manufacturing. Market players like Thomson Reuters Corporation, Wolters Kluwer NV, Avalara, Inc., Vertex, Inc., and Sovos Compliance, LLC are key drivers of innovation and growth in the industry, providing a wide range of software and services to enhance tax processes, compliance, and operational efficiency for businesses worldwide.

One notable trend shaping the market is the integration of artificial intelligence (AI) and machine learning (ML) capabilities into tax tech solutions. These technologies enable advanced data analytics, predictive modeling, and automation of repetitive tasks, improving accuracy and efficiency in tax operations. With AI and ML algorithms, businesses gain valuable insights, streamline decision-making processes, and proactively address tax-related challenges. This trend showcases the industry's commitment to leveraging cutting-edge technologies to enhance tax management practices.

Another critical aspect influencing the market is the increasing focus on cybersecurity and data privacy within tax tech solutions. As organizations manage sensitive financial data and tax information, ensuring robust security measures and compliance with privacy regulations is paramount. Tax tech providers are prioritizing cybersecurity protocols, encryption techniques, and secure cloud infrastructure to safeguard client data against cyber threats. The emphasis on data security is driving the demand for tax tech solutions with integrated protection mechanisms to ensure the confidentiality and integrity of financial information.

Furthermore, the market is witnessing a shift towards customized and industry-specific tax tech solutions to address the unique needs of diverse sectors. Industries like BFSI, healthcare, retail, and manufacturing require tailored tax solutions to navigate specific tax challenges and regulatory requirements effectively. Providers are developing specialized modules, compliance frameworks, and reporting tools to cater to the distinct tax landscapes of different industries. This trend highlights the importance of industry-specific solutions in enhancing operational efficiency and ensuring regulatory compliance for businesses operating in various sectors.

In conclusion, the Global Tax Tech Market is evolving rapidly, driven by technological advancements, regulatory dynamics, and the increasing globalization of business operations. By embracing emerging technologies, prioritizing data security, offering industry-specific solutions, and addressing global tax challenges, market players can position themselves for success in an ever-changing market landscape. The continued innovation and adaptation to market trends will be crucial for businesses seeking to optimize tax processes, ensure compliance, and drive strategic tax planning initiatives efficiently.

The Tax Tech Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-tax-tech-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Core Objective of Tax Tech Market:

Every firm in the Tax Tech Market has objectives but this market research report focus on the crucial objectives, so you can analysis about competition, future market, new products, and informative data that can raise your sales volume exponentially.Size of the Tax Tech Market and growth rate factors.

- Important changes in the future Tax Tech Market.

- Top worldwide competitors of the Tax Tech Market.

- Scope and product outlook of Tax Tech Market.

- Developing regions with potential growth in the future.

- Tough Challenges and risk faced in Tax Tech Market.

Global Tax Tech Market top manufacturers profile and sales statistics.

Browse More Reports:

Global Agriculture Packaging Market

Global Wrist Wearable Market

Global Cardiac Pacemakers Market

Global Anti-Drone Market

Global Aqua Gym Equipment Market

North America Circuit Breaker and Fuses Market

Global Radio-Frequency Identification Technology (RFID) Market

Asia-Pacific Commercial Turf Utility Vehicle Market

Europe RF Over Fiber Market

Global Solar Photovoltaic (PV) Mounting Systems Market

Middle East and Africa Silicon Anode Material Battery Market

Global Energy Intelligence Solution Market

North America Bio-based Lubricants Market

Global Cable Television (CATV) Broadcasting Equipment Market

Global Fatty Liver Diseases Treatment Market

Global Plant Breeding and CRISPR Plant Market

Global Automotive HUD Market

Global Puncheon Barrel Market

Global Multi Touch Display Market

Global Robotic Staplers Market

Global Overactive Bladder Treatment Market

Global Natural Flavours and Fragrances Market

Global Urine Test Strips Market

Global Land Mobile Radio Market

Global Automated Fingerprint Identification System (AFIS) Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"