"Executive Summary Bitcoin Payments Ecosystem Market :

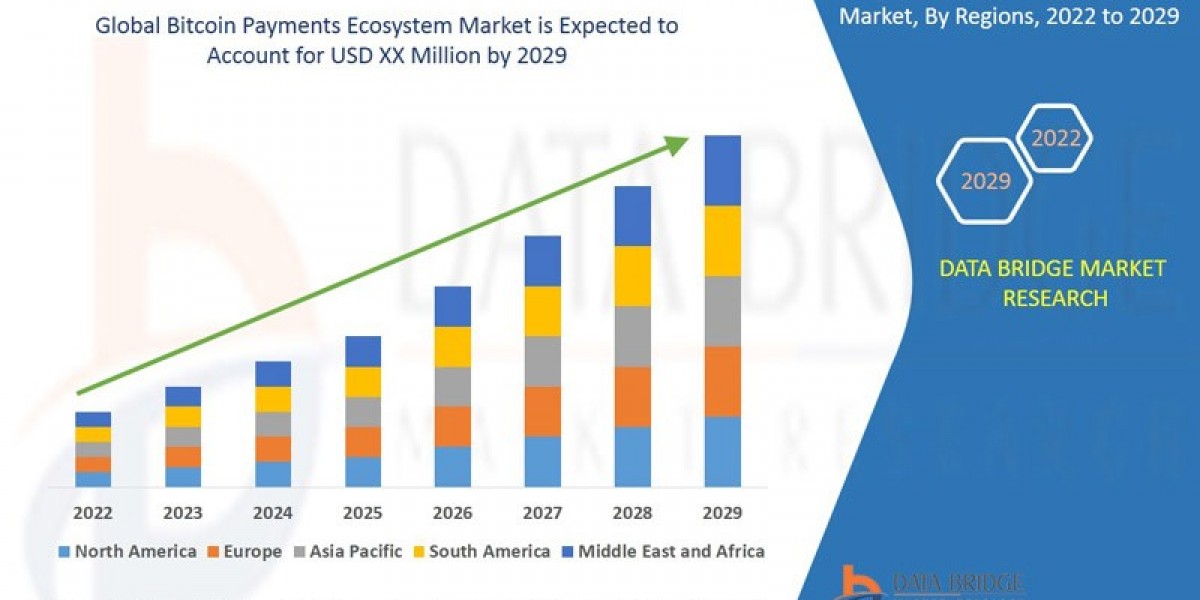

Bitcoin payments ecosystem market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses the market to grow at a CAGR of 44.0% in the above-mentioned forecast period.

This Bitcoin Payments Ecosystem Market document provides market segmentation in the most-detailed pattern. A thorough analysis of patents and major market players has been carried out in this Bitcoin Payments Ecosystem Market report to provide a competitive landscape. High level market analysis of major segments has been performed in the report and opportunities are identified. The report not only deals with major industrial categories but also different associated segments such as services, technologies, & applications. What is more, Bitcoin Payments Ecosystem Market report provides market data in such a way that it also considers new product development from beginning to launch.

Bitcoin Payments Ecosystem Market report assists in finding out prospective in new geographical markets and performs market analysis to successfully get bigger into them. After identifying trends in consumer and supply chain dynamics, accordingly marketing, promotional and sales strategies are interpreted for an utmost success. The report is also helpful to gain knowledge and insights about the new regulatory environment which suits to the organization. To design this report at its best, a DBMR team works with respect to the opportunities, challenges, drivers, market structures, and competitive landscape for utmost success of the clients.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Bitcoin Payments Ecosystem Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-bitcoin-payments-ecosystem-market

Bitcoin Payments Ecosystem Market Overview

**Segments**

- By Type:

- Cryptocurrency Exchanges

- Remittance Services

- Payment and Wallet

- Mining Services

- System Integrators

- The blockchain API end-use applications

- By Application:

- Unbanked

- Remittance

- E-commerce

- Media and Entertainment

- Others

- By Geography:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East and Africa

Bitcoin is revolutionizing the global payments ecosystem with its decentralized nature and security features. In terms of type, the market is segmented into cryptocurrency exchanges, remittance services, payment and wallet solutions, mining services, system integrators, and blockchain API end-use applications. Cryptocurrency exchanges play a key role in facilitating the buying and selling of Bitcoin and other digital assets. Remittance services leverage Bitcoin's speed and cost-effectiveness for cross-border money transfers. Payment and wallet solutions provide users with secure storage and easy access to their Bitcoin holdings. Mining services are crucial for maintaining the Bitcoin network through the validation of transactions. System integrators offer tailored solutions for businesses looking to adopt Bitcoin payments, while blockchain API applications enable seamless integration of Bitcoin into various platforms.

In terms of application, the Bitcoin payments ecosystem serves a diverse range of sectors. The unbanked population benefits from Bitcoin's accessibility as a decentralized form of money. Remittance services are increasingly using Bitcoin for international money transfers due to lower fees and faster transaction times compared to traditional methods. E-commerce businesses are integrating Bitcoin payments to cater to tech-savvy customers looking for alternative payment options. The media and entertainment industry is exploring Bitcoin for content monetization and copyright protection. Other applications of Bitcoin in the payments ecosystem include micropayments, donations, and gaming.

Geographically, the global Bitcoin payments ecosystem market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. North America leads the market due to the widespread adoption of Bitcoin and favorable regulations. Europe is also a key region for Bitcoin payments, with countries like Switzerland and the Netherlands embracing cryptocurrencies. The Asia-Pacific region is seeing rapid growth in Bitcoin adoption, driven by countries like Japan, South Korea, and Singapore. In South America, countries like Venezuela are turning to Bitcoin as a hedge against hyperinflation. The Middle East and Africa are also exploring the potential of Bitcoin for financial inclusion and cross-border payments.

**Market Players**

- Coinbase

- BitPay

- CoinGate

- Shopify

- GoURL

- Coinify

- Blockonomics

- BIPS

- SpectroCoin

- CoinPayments

These market players are key influencers in the global Bitcoin payments ecosystem, offering various services such as payment processing, wallet solutions, and merchant tools to facilitate the adoption of Bitcoin as a payment method.

The global Bitcoin payments ecosystem market is experiencing significant growth driven by the increased adoption of cryptocurrencies as a viable payment solution across various industries. One key trend shaping the market is the rising acceptance of Bitcoin by mainstream businesses and consumers, leading to a shift towards digital payments. This trend is fueled by factors such as lower transaction costs, faster payment processing times, and enhanced security features offered by blockchain technology. As more businesses and individuals recognize the benefits of using Bitcoin for payments, the market is expected to witness further expansion in the coming years.

Another important aspect impacting the Bitcoin payments ecosystem is the regulatory environment surrounding cryptocurrencies. While some regions have embraced Bitcoin and implemented favorable regulations to promote its use, others have displayed caution or even hostility towards digital currencies. Regulatory developments can significantly influence the growth and adoption of Bitcoin payments, with clear and supportive regulations likely to boost market activities while regulatory uncertainty may hinder widespread acceptance.

Moreover, technological advancements in the blockchain space are driving innovation in the Bitcoin payments ecosystem. The development of scalable, efficient, and user-friendly blockchain solutions is opening up new possibilities for businesses to integrate Bitcoin into their payment systems seamlessly. This technological progress is enhancing the overall user experience, reducing barriers to entry, and expanding the usability of Bitcoin in everyday transactions. As blockchain technology continues to evolve, we can expect to see further improvements in the Bitcoin payments ecosystem, leading to enhanced efficiency, security, and convenience for users worldwide.

Additionally, the competitive landscape of the Bitcoin payments ecosystem is evolving as new players enter the market and existing ones expand their offerings. Market players are focusing on enhancing their services, developing innovative solutions, and forming strategic partnerships to stay ahead in the competitive environment. Collaborations between traditional financial institutions, fintech companies, and blockchain startups are creating unique opportunities for growth and diversification within the Bitcoin payments ecosystem. This dynamic market landscape is driving continuous innovation and differentiation among market players, ultimately benefiting consumers and businesses seeking efficient and secure payment solutions.

In conclusion, the global Bitcoin payments ecosystem market is poised for continued growth and evolution driven by technological advancements, regulatory developments, and increasing acceptance among businesses and consumers. As the market matures and expands, we can expect to see further innovations, partnerships, and regulatory changes that will shape the future of Bitcoin payments on a global scale. Market players will need to adapt to these trends and seize the opportunities presented to establish a strong presence and drive sustainable growth in the dynamic and rapidly evolving Bitcoin payments ecosystem.The global Bitcoin payments ecosystem is witnessing a paradigm shift in the way payments are conducted across various industries. This transformation is primarily driven by the decentralized nature and security features of Bitcoin, which offer lower transaction costs, faster processing times, and enhanced security compared to traditional payment methods. Mainstream businesses and consumers are increasingly recognizing the advantages of using Bitcoin for payments, leading to a growing acceptance of cryptocurrencies in the global payments landscape. As a result, the market is experiencing significant growth, with increasing adoption and integration of Bitcoin into everyday transactions.

Regulatory environments play a crucial role in shaping the Bitcoin payments ecosystem, impacting the growth and adoption of cryptocurrencies. While some regions have embraced Bitcoin and implemented favorable regulations to promote its use, regulatory uncertainty in other areas may hinder the widespread acceptance of digital currencies. Clear and supportive regulations are essential for driving market activities and building trust among users and businesses. Therefore, regulatory developments will continue to influence the evolution of the Bitcoin payments ecosystem, with a balance needed between innovation and regulatory compliance to foster sustainable market growth.

Technological advancements in the blockchain space are driving innovation and efficiency in the Bitcoin payments ecosystem. The development of scalable and user-friendly blockchain solutions is opening up new opportunities for businesses to seamlessly integrate Bitcoin into their payment systems. These advancements enhance the overall user experience, reduce barriers to entry, and increase the usability of Bitcoin in various applications. As blockchain technology evolves, we can expect further improvements in the efficiency, security, and convenience of Bitcoin payments, making it an attractive option for businesses and consumers alike.

The competitive landscape of the Bitcoin payments ecosystem is evolving rapidly, with market players focusing on enhancing services, developing innovative solutions, and forming strategic partnerships to stay ahead. Collaboration between traditional financial institutions, fintech companies, and blockchain startups is creating unique growth opportunities within the ecosystem. This dynamic market environment encourages continuous innovation and differentiation among market players, ultimately benefiting consumers and businesses seeking efficient and secure payment solutions. As the market matures and expands, we anticipate further innovations, partnerships, and regulatory changes that will shape the future of Bitcoin payments on a global scale, presenting new challenges and opportunities for market players to navigate and capitalize on.

The Bitcoin Payments Ecosystem Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-bitcoin-payments-ecosystem-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the Bitcoin Payments Ecosystem Market.

- Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market.

- Competitive Assessment:In-depth assessment of the market strategies, geographic and business segments of the leading players in the market.

- Market Development:Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies.

- Market Diversification:Exhaustive information about new products, untapped geographies, recent developments, and investments in the Bitcoin Payments Ecosystem Market.

Browse More Reports:

Middle East and Africa Fiber Optic Heat Detector and System Integrator Market

Global Advanced Therapeutics Market

Global Heatstroke Treatment Market

Global Clonorchiasis Market

Asia-Pacific Angioplasty Balloons Market

Global Air Runner Market

Global Label Printer Market

Global Inhalers and Nebulizers Market

Europe Acetone Market

Global Corporate Banking Solutions Market

Global Paraquat Market

Global Lip Fillers Market

Global Fiber Optic Heat Detector and System Integrator Market

Global Triacetin Market

Global Bitcoin Payments Ecosystem Market

Europe Sports Medicine Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"